Property & Casualty Insurance Market Size

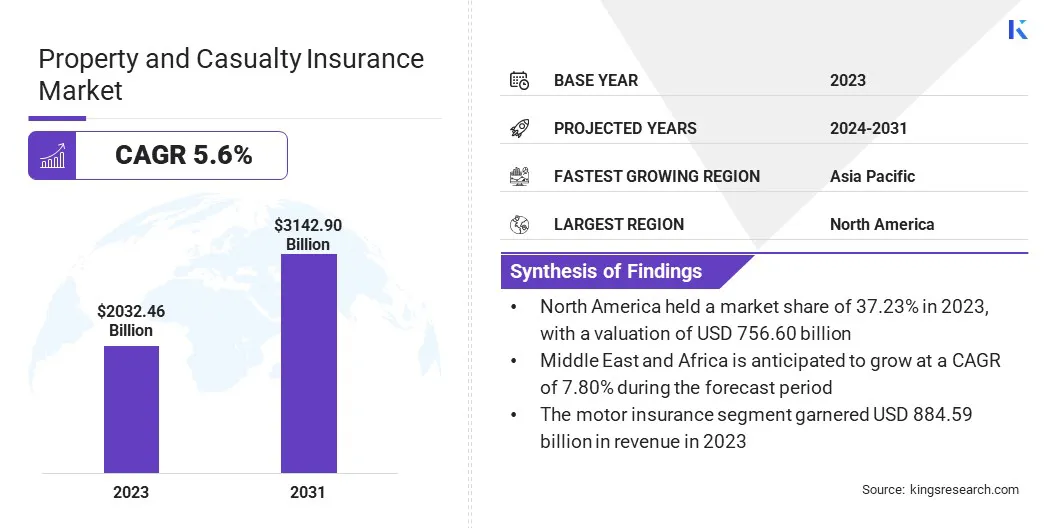

The global Property & Casualty Insurance Market size was valued at USD 2,032.46 billion in 2023 and is projected to reach USD 3,142.90 billion by 2031, growing at a CAGR of 5.6% from 2024 to 2031. In the scope of work, the report includes solutions offered by companies such as State Farm Group, Berkshire Hathaway Specialty Insurance, Progressive Casualty Insurance Company, Allstate Insurance Company, Liberty Mutual Insurance, The Travelers Indemnity Company, USAA, Chubb, Nationwide Mutual Insurance Company, Farmers and Others.

This growth is propelled by escalating natural calamities, regulatory changes, technological advancements, and evolving customer expectations. These elements compel insurers to innovate and introduce new products, necessitating the deployment of risk management protocols and the elevation of customer experiences to maintain competitiveness and profitability.

The property & casualty insurance market encompasses various segments such as automobile, residential, commercial, and others. It is characterized by intense competition among major entities such as State Farm Group, Berkshire Hathaway Specialty Insurance, and Progressive Casualty Insurance Company. Emerging markets, notably in the Asia-Pacific and Latin America regions, are experiencing rapid expansion due to increased economic activities and insurance penetration.

The property and casualty insurance sector faces challenges such as climate-induced risks, cybersecurity vulnerabilities, intricate regulatory frameworks, and mounting claims expenses. To tackle these challenges, insurers are investing in advanced analytics for precise risk assessment, leveraging digital platforms for operational streamlining, fortifying cybersecurity measures, and collaborating closely with regulators to ensure compliance and safeguard consumer interests.

Analyst’s Review

The property & casualty insurance market continues to witness growth, driven by factors such as increasing awareness of risks, regulatory reforms, and technological advancements in the sector. Insurers are focusing on innovation, digitalization, and customer-centric solutions to maintain a competitive edge. However, the market is facing major challenges such as climate-related risks, and regulatory complexities, among evolving customer expectations.

However, the market is expected to experience opportunities with the introduction of new products based on evolving market dynamics and the integration of advanced technologies, providing suitable opportunities for expansion, particularly in emerging economies and niche segments in the forecast duration.

Property & Casualty Insurance Market Growth Factors

The integration of modern technology, including artificial intelligence (AI), big data analytics, and the Internet of Things (IoT), is reshaping the P&C insurance market landscape. These technologies improve risk assessment, enhance customer service through faster claims processing, and enable the development of personalized insurance products. However, risks related to cyber threats persist, requiring significant investment in the development of complementing digital infrastructure. The ability of insurers to adapt and innovate with technological advancements highlights their competitiveness and growth potential in an increasingly digital world.

The increasing frequency and severity of natural disasters due to climate change significantly impact the property & casualty insurance market, as disasters such as hurricanes, wildfires, and floods lead to the payout of higher claims. This forces insurers to reassess their risk models and adjust premiums. It potentially drive short-term revenue growth for insurers in high-risk areas; however, it places a burden on the long-term sustainability and profitability of the industry. Insurers are offering affordable policies while maintaining financial resilience against the risks associated with climate change.

Property & Casualty Insurance Market Trends

Insurers are increasingly utilizing AI and machine learning technologies to enhance underwriting processes, claims management, and customer service. These technologies enable real-time data analysis, automation of risk assessment, fraud detection, and personalized policy offerings. Integrating AI-driven tools into their operations is enabling insurers to improve efficiency, accuracy, and decision-making, leading to better risk management and enhanced customer experience.

Economic expansion and the increase in construction activities are driving the growth of the property & casualty insurance market. Economic growth enables businesses and individuals to insure more assets, including real estate and vehicles, leading to higher demand for insurance products. Moreover, the surge in construction activities is prompting the need for additional coverage for construction projects. This is resulting in the growth of commercial and residential property insurance, creating potential opportunities for insurers to raise premiums. However, this requires them to manage and mitigate risks associated with new developments.

Segmentation Analysis

The global market is segmented based on type, distribution channel, and geography.

By Type

Based on type, the market is segmented into motor insurance, liability insurance, homeowners’ insurance, and others. The motor insurance segment led the property & casualty insurance market in 2023, reaching a valuation of USD 884.59 billion. This growth is mainly attributable to stringent legal mandates, high vehicle volumes, and frequent claims. The diverse coverage options offered by insurance companies, along with technological advancements, aid in risk assessment and claims processes, fostering fierce competition and promoting innovation and affordability for consumers. These factors are driving demand and significantly contributing to the growth of the motor insurance segment.

By Distribution Channel

Based on distribution channel, the market is divided into agency, direct, banks, and others. The agency segment secured the largest revenue share of 37.86% in 2023 due to their commitment to personalized service, which fosters long-term relationships, as well as its expertise and accessibility to consumers. Agencies serves as representatives for multiple insurers, offering a diverse range of products and aiding in claims processing, thus ensuring adherence to the regulatory framework while also allowing consumers to adapt to market changes.

- Agencies with strong brand recognition provide consumer-centric services along with comprehensive insurance solutions, fostering trust and loyalty among clients. These factors are supporting the dominance of agencies in the global marketplace.

Property & Casualty Insurance Market Regional Analysis

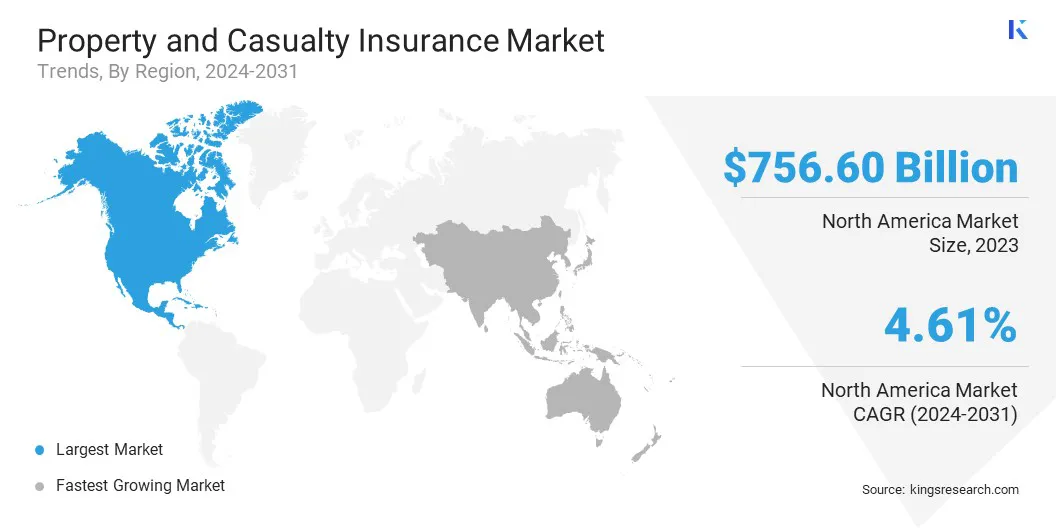

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Property & Casualty Insurance Market share stood around 37.23% in 2023 in the global market, with a valuation of USD 756.60 Billion. This leading position is attributed to economic stability in the region. High insurance penetration, coupled with technological advancements and a favorable regulatory environment, creates a robust insurance sector in North America. This sector efficiently addresses various risks, fosters innovation, and ensures widespread coverage, thereby solidifying North America's prominent position in the global market.

Middle East and Africa is poised to experience significant growth over the forecast period, depicting a CAGR of 7.80% due to the booming economy in the region. As urban populations continue to rise, both individuals and businesses are seeking insurance coverage for safeguarding their assets and merchandise. Additionally, the advent of new technologies, along with public sector support, is boosting investment in the region, thus positioning it to experience the fastest growth in the forecast duration.

Competitive Landscape

The property & casualty insurance market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for market growth.

List of Key Companies in Property & Casualty Insurance Market

- State Farm Group

- Berkshire Hathaway Specialty Insurance

- Progressive Casualty Insurance Company

- Allstate Insurance Company

- Liberty Mutual Insurance

- The Travelers Indemnity Company

- USAA

- Chubb

- Nationwide Mutual Insurance Company

- Farmers

Key Industry Developments

- April 2024 (Acquisition): Corebridge Financial, Inc. announced the finalization of the divestiture of its life insurance business in the UK – AIG Life Limited to Aviva Plc. This strategic move was undertaken to enable Corebridge to focus specifically on its Life & Retirement products and solutions within the United States.

- April 2024 (Partnership): Lemonade, in partnership with BNP Paribas Cardif, launched homeowners’ insurance in France. This fully digital offering, available via the Lemonade App or online platforms, aims to make insurance more accessible to customers. The product includes industry-standard coverage and additional options such as school insurance, legal protection, and theft coverage. This move marks Lemonade's expansion in Europe and aligns with BNP Paribas Cardif's strategy to enhance customer experience through technology.

The global Property & Casualty Insurance Market is segmented as:

By Type

- Motor Insurance

- Liability Insurance

- Homeowners insurance

- Others

By Distribution Channel

- Agency

- Direct

- Banks

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America